Key Pointers

- MicroStrategy adds 1,070 BTC to its holdings, spending $101 million at an average price of $94,004 per coin.

- The company now owns 447,470 BTC, valued at over $45.5 billion at current prices.

- This marks the ninth consecutive week of Bitcoin purchases following Trump’s reelection.

- Concerns grow over the sustainability of MicroStrategy’s aggressive Bitcoin strategy.

MicroStrategy is at it again. The company, led by Bitcoin evangelist Michael Saylor, has purchased another 1,070 BTC, spending $101 million as part of its relentless Bitcoin acquisition strategy.

60 billionaires already hold #Bitcoin.

The other 2,700 will join soon or later. If each invests just $500M, that’s $1.35 TRILLION flowing in.Only 2.2M BTC left on exchanges.

BTC price could hit $900K+ instantly. Supply is vanishing. FOMO will do the rest. 👇 pic.twitter.com/UUvkuWPvik

— Michael Saylor ⚡ Founder of MicroStrategy (Parody) (@Saylorsatsire) January 6, 2025

This latest buy, disclosed in an SEC filing and a public announcement, brings MicroStrategy’s total Bitcoin holdings to a staggering 447,470 BTC. At today’s Bitcoin price of $101,832, the company’s crypto stash is valued at more than $45.5 billion.

A Steady Buying Spree

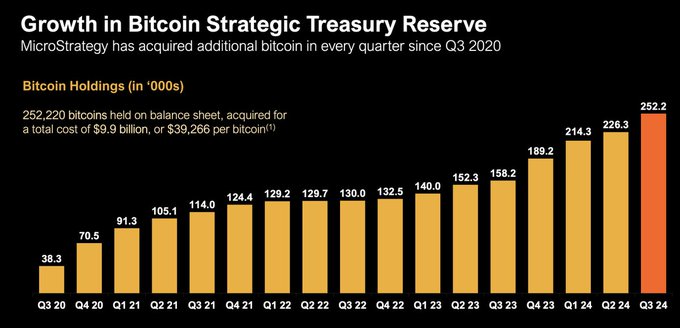

MicroStrategy has bought #Bitcoin in every quarter since Q3 2020

MicroStrategy’s weekly Bitcoin purchases began in November 2024, shortly after Donald Trump’s reelection. Initially, these buys were massive:

- $2 billion worth of Bitcoin was purchased the Monday following Trump’s win.

- The next week, the company added $4.6 billion worth of BTC.

- This was followed by its single-largest purchase yet: $5.4 billion in Bitcoin.

While recent buys have been smaller, MicroStrategy has remained consistent, making Bitcoin purchases every week for the past nine weeks.

Investors’ Mixed Reactions

Prediction markets had been betting on MicroStrategy crossing the 450,000 BTC mark by the end of this week.

🧵 1/ For years, Michael @saylor has been giving away his long term business plan, through cryptic parables of “Digital Energy” and a “Magic Hotel,” but few have understood them. MicroStrategy’s business plan appears to be much bigger than people realize. Let’s find out why👇 pic.twitter.com/WqYK0C5PhE

— Level39 (@level39) March 14, 2024

Platforms like Myriad estimated an 86% chance of the company hitting that milestone. But with this relatively modest purchase, those odds have dropped to 20%, according to user sentiment.

Similarly, Polymarket users currently give only a 2% chance that MicroStrategy will hold more than 500,000 BTC by Trump’s inauguration on January 20, 2025.

A Risky but Lucrative Strategy

Michael Saylor has doubled down on Bitcoin as a core part of MicroStrategy’s identity. Once a software company focused on data analytics, the firm has now rebranded itself as a Bitcoin development company.

Its primary business? Securitizing Bitcoin and offering investors exposure to the cryptocurrency through its Nasdaq-listed shares.

MicroStrategy’s stock is up over 500% year-to-date, making it one of the best-performing assets in the market.

This bold move has paid off — at least so far. MicroStrategy’s stock is up over 500% year-to-date, making it one of the best-performing assets in the market.

Saylor’s logic is simple: Bitcoin’s scarcity makes it the ultimate hedge against inflation and a superior way to preserve wealth. He first adopted this strategy in 2020, during the pandemic, when low interest rates and economic uncertainty threatened shareholder value.

But not everyone is convinced.

Critics worry that MicroStrategy’s heavy reliance on Bitcoin could backfire if the cryptocurrency’s price takes a significant hit. The company is highly leveraged, and some analysts believe its stock price is overvalued, making it vulnerable to a market downturn.

The Road Ahead

As Bitcoin continues its march toward $100,000 and beyond, MicroStrategy remains one of the biggest bets on the cryptocurrency’s future. Whether this bold strategy will pay off in the long term or expose the company to unsustainable risks remains to be seen.

For now, Michael Saylor is sticking to his mantra: “HODL.” And with a treasury of nearly half a million BTC, MicroStrategy is cementing its place as the ultimate Bitcoin whale.