Let’s be real for a second.

You probably didn’t wake up this morning thinking, “I wonder what consensus mechanisms blockchains use?”

But if you’ve ever dipped your toes into crypto, cared about the environment, or wondered about the future of money, you might want to listen up.

Because behind the buzzwords like Proof of Work vs Proof of Stake (PoS) lie some real-world consequences that affect us all.

These aren’t just tech terms for the blockchain bros. They’re about trust, energy, security, and the future of decentralized systems.

And believe it or not, the choice between these two systems shapes the way you — and the world — experience crypto.

So let’s strip away the jargon, inject some reality, and figure out why this matters to you.

WTF Are Proof of Work and Proof of Stake, Anyway?

Imagine you have a treasure vault — it’s filled with gold, diamonds, and maybe a rare Pokémon card or two. You want to keep it safe. But how do you decide who gets to protect the vault and ensure that everything inside stays legit?

That’s where Proof of Work (PoW) and Proof of Stake (PoS) come in. They’re like two different methods for keeping your treasure safe and verified.

Here’s a simple breakdown:

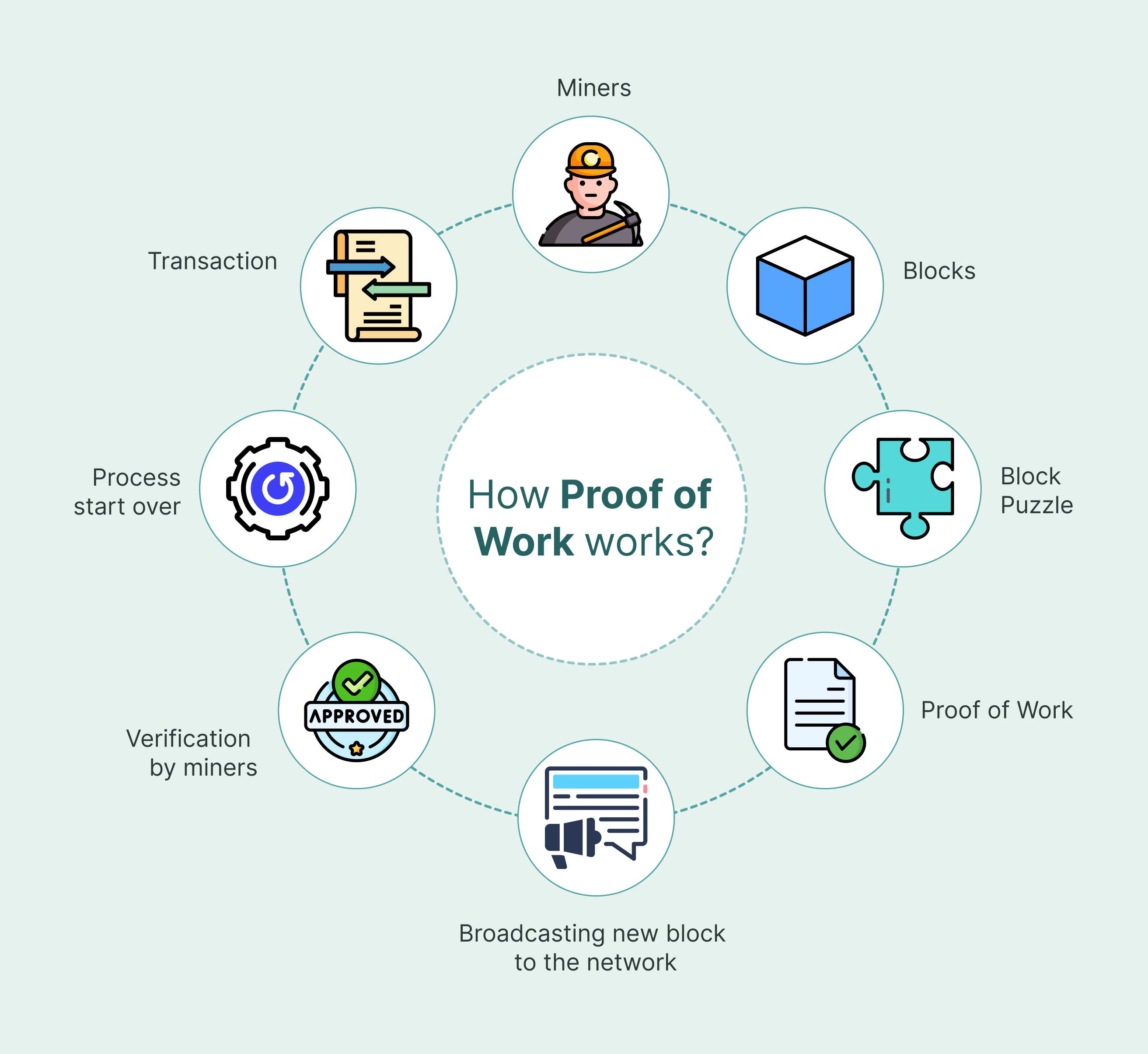

- Proof of Work (PoW) is like a high-stakes, never-ending math competition. Computers (called miners) race to solve incredibly complex puzzles. The first one to solve it gets to add a new block of transactions to the blockchain — and they get rewarded with crypto.

- Proof of Stake (PoS) is like a crypto lottery. Instead of solving puzzles, people (called validators) are randomly chosen to verify transactions. But there’s a catch: the more crypto you “stake” (lock up), the higher your chances of being picked. Think of it as putting your money where your mouth is.

Different methods. Same goal: keeping the blockchain secure and trustworthy.

Why Did We Need Proof of Work in the First Place?

Back in 2008, when Satoshi Nakamoto introduced Bitcoin to the world, they were solving a massive problem:

How do you create a digital currency that no one controls, that you can trust, and that can’t be faked?

Enter Proof of Work.

Why PoW Works Like a Charm

- Security: To attack a PoW network like Bitcoin, you’d need to control more than 51% of the entire network’s computing power. That’s like trying to break into a vault guarded by thousands of supercomputers. Nearly impossible.

- Trust Without Trust: You don’t need to trust anyone. The math competition ensures everyone plays fair. The result? A system where no single entity can tamper with the records.

- Incentives: Miners are rewarded with Bitcoin for solving puzzles. This encourages people to keep the network secure and running.

But here’s the catch: Proof of Work is incredibly energy-intensive. And that’s where the controversy kicks in.

The Elephant in the Room: PoW and Energy Consumption

You’ve heard the headlines:

- “Bitcoin uses as much energy as Norway.”

- “Crypto mining is killing the planet.”

And you know what? There’s truth to that.

Why Does PoW Use So Much Energy?

Those complex puzzles miners solve? They require an insane amount of computing power. And computing power = electricity.

In 2024, Bitcoin’s network consumed around 130 terawatt-hours of electricity per year — enough to power 13 million homes.

But here’s something most people don’t tell you:

- Renewable Energy: About 60% of Bitcoin mining is powered by renewable energy sources like hydro, wind, and solar. In fact, Bitcoin miners are often the first to adopt stranded or excess energy that would otherwise go to waste.

- Securing Billions in Value: Bitcoin’s network secures over $2 trillion in assets. Compare that to the energy cost of securing traditional banking systems or gold mining, and things start to look more nuanced.

But still, the energy debate is real. And that’s why some blockchains have turned to a different system: Proof of Stake.

Proof of Stake: The Greener, Faster Alternative

If Proof of Work is a math competition, Proof of Stake is more like a weighted lottery. Validators don’t need to solve puzzles. Instead, they stake their crypto — essentially locking it up as collateral — to be chosen to verify transactions.

Why PoS Is Gaining Ground

- Energy Efficiency: No puzzle-solving means no insane energy consumption. When Ethereum switched to PoS in 2022, its energy use dropped by 99.95% overnight.

- Scalability: PoS networks can process more transactions per second (TPS). While Bitcoin manages around 7 TPS, PoS blockchains like Solana can handle over 2,000 TPS.

- Accessibility: You don’t need expensive mining rigs. Anyone with a decent amount of crypto can participate as a validator.

But Is PoS Perfect? Not Exactly.

Here’s where things get interesting.

The Downsides of PoS

- Rich Get Richer: The more crypto you stake, the higher your chances of being chosen as a validator. This can lead to wealth concentration — a problem PoW avoids by design.

- Security Concerns: PoS networks are newer and haven’t faced the same level of battle-testing as Bitcoin’s PoW. Some worry that PoS might be more vulnerable to certain attacks.

- Centralization Risk: If a few validators control most of the staked crypto, they could potentially collude or manipulate the network.

Proof Of Work Vs Proof Of Stake – Which One Wins?

It’s not a battle of good vs. evil. Both systems have their strengths and weaknesses. The real question is: What kind of future do we want?

- If you believe in decentralized, battle-tested security — you might prefer Proof of Work.

- If you care about sustainability and scalability — you might lean towards Proof of Stake.

But here’s the thing: There’s room for both. Bitcoin can keep doing its thing with PoW, while other networks like Ethereum can thrive with PoS.

Why You Should Give a Damn

- If you’re investing in crypto: Knowing PoW vs. PoS helps you understand what you’re buying into.

- If you care about the environment: PoS offers a path forward without the energy debate.

- If you care about decentralization: PoW’s security model is hard to beat.

The future of money, trust, and decentralized systems is being shaped right now. The more you understand these systems, the better you can navigate this wild world of crypto.

So, what do you think? Are you Team PoW, Team PoS, or Team “Why Not Both?” Let’s talk about it. 🚀💬