Curious about the buzz surrounding cryptocurrency? You’re not alone. With headlines full of Bitcoin booms and blockchain breakthroughs, it’s no wonder everyone’s asking, “What is cryptocurrency?”

At its core, cryptocurrency is digital money that operates on a technology called blockchain. Unlike traditional currencies controlled by central banks, cryptocurrencies are decentralized, meaning no single entity governs them.

But why is cryptocurrency so important? It represents a shift towards a more open, secure, and efficient financial system. Imagine sending money to a friend across the world in seconds, without relying on banks or paying hefty fees. That’s the power of cryptocurrency.

Cryptocurrency is not just a tool for tech enthusiasts or investors; it’s becoming part of everyday life. From buying coffee to making international payments, cryptocurrencies are gradually finding their place in the global economy. Understanding cryptocurrency is essential, whether you’re looking to invest, explore new technologies, or stay ahead in a rapidly changing world.

How Does Cryptocurrency Work?

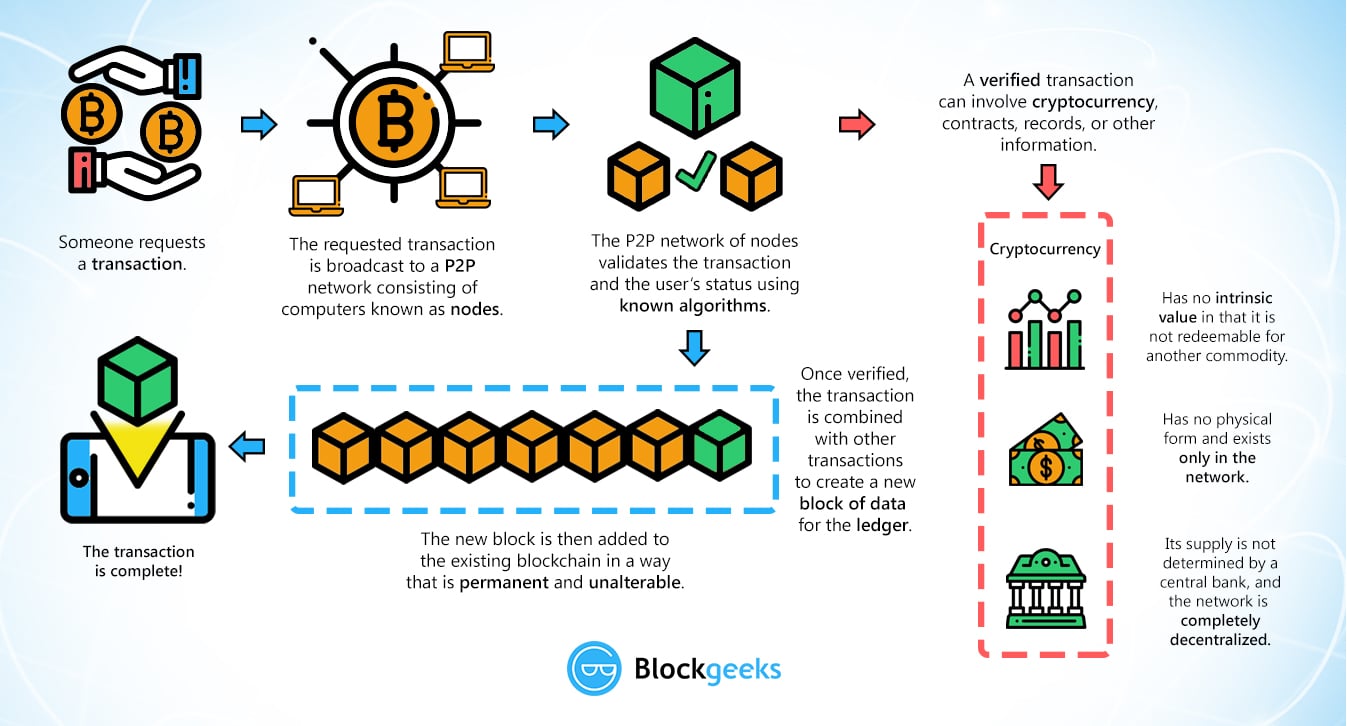

Source – Blockgeeks

To grasp cryptocurrency, you need to understand the technology that powers it—blockchain. Think of blockchain as a digital ledger, a record book that’s shared across a network of computers.

Every time someone makes a transaction with cryptocurrency, it’s recorded on this ledger. But unlike traditional ledgers, once information is added to the blockchain, it can’t be changed. This immutability ensures that every transaction is secure and transparent.

Each block in the blockchain contains a list of transactions. When a block is filled, it’s added to the chain, hence the name “blockchain.” These blocks are linked together in a chronological order, creating a permanent record of all transactions.

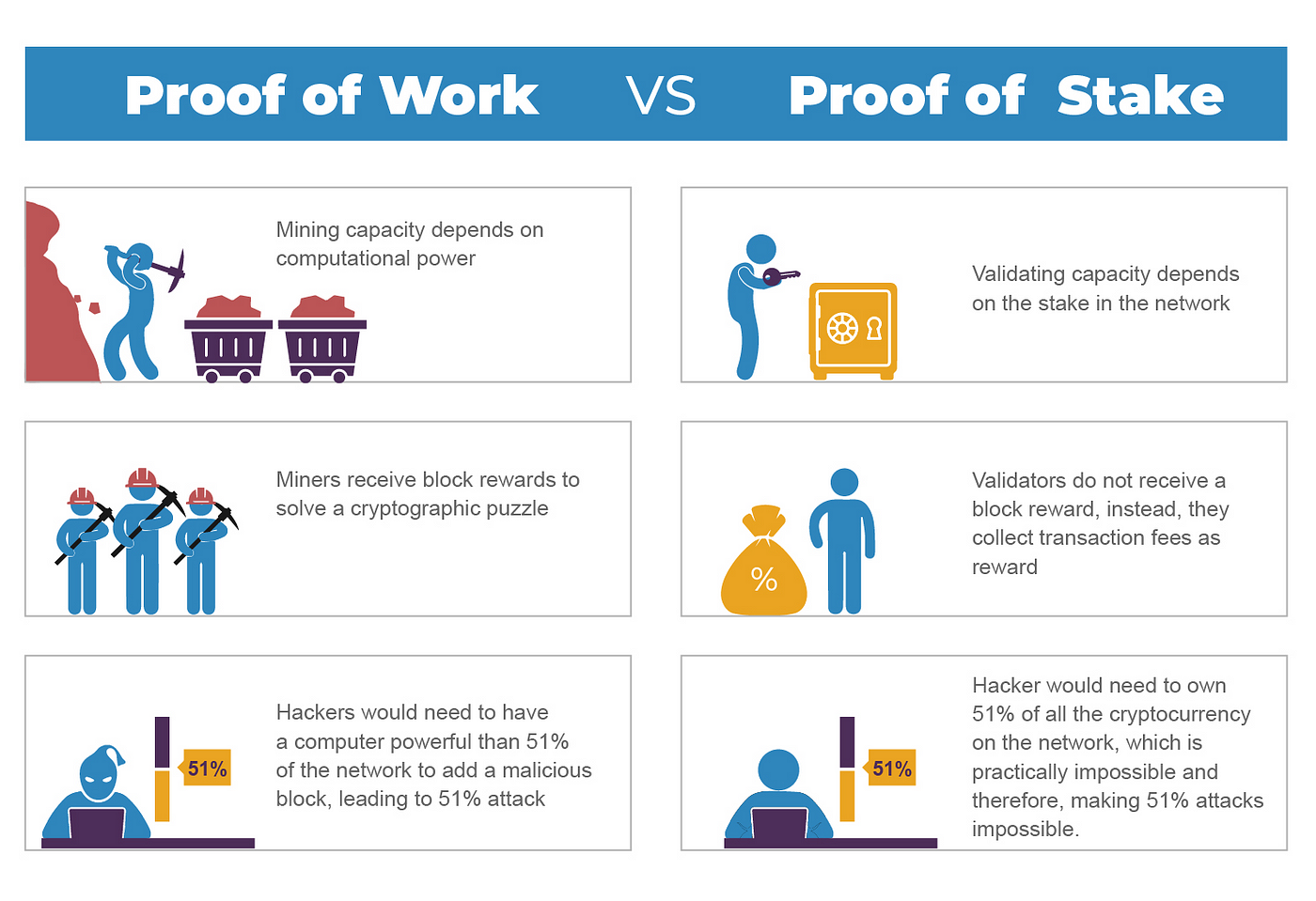

To ensure that every transaction is legitimate, blockchain relies on a consensus mechanism. This is where things get interesting. Different cryptocurrencies use various methods to achieve consensus, but the most common are Proof of Work (PoW) and Proof of Stake (PoS).

Source Durwin Ho – Medium

- Proof of Work (PoW): In this system, computers, known as miners, compete to solve complex mathematical problems. The first one to solve the problem gets to add the next block to the blockchain and is rewarded with cryptocurrency. This process requires significant computational power, which is why you might have heard about the energy consumption associated with Bitcoin mining.

- Proof of Stake (PoS): Instead of miners, PoS uses validators who are chosen based on the number of coins they hold and are willing to “stake” as collateral. This method is more energy-efficient and is used by cryptocurrencies like Ethereum 2.0 and Cardano.

Understanding how these systems work isn’t just for techies. It gives you a deeper insight into why cryptocurrencies are secure, decentralized, and resistant to censorship. The consensus mechanisms are what make blockchain trustworthy, allowing users to transact without the need for a middleman like a bank.

The Origins of Cryptocurrency

Cryptocurrency didn’t just appear out of nowhere; it has roots in the 1980s and 1990s with the rise of the cypherpunk movement. Cypherpunks were activists advocating for the use of cryptography to protect individual privacy in the digital age. They envisioned a world where people could conduct financial transactions without government oversight or corporate interference.

The first attempt at creating digital money was DigiCash in the late 1980s, followed by e-gold in the 1990s. Both were centralized systems that ultimately failed due to legal challenges and security issues. However, they laid the groundwork for what was to come.

The real breakthrough came in 2008 when an anonymous person (or group) known as Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Bitcoin: A Peer-to-Peer Electronic Cash System.

This whitepaper introduced Bitcoin, the first true cryptocurrency, and the concept of blockchain technology. Satoshi’s vision was to create a decentralized currency that allowed people to transfer value directly to each other without relying on intermediaries.

Bitcoin’s launch in 2009 marked the beginning of the cryptocurrency revolution. It quickly gained traction among tech enthusiasts, and over the next few years, other cryptocurrencies emerged, each offering unique features and improvements on Bitcoin’s design.

Popular Types of Cryptocurrencies

Today, there are thousands of cryptocurrencies, each with its own strengths and weaknesses. Here’s a look at some of the most popular ones:

- Bitcoin (BTC): The original cryptocurrency, often referred to as “digital gold.” Bitcoin is known for its limited supply (only 21 million will ever exist) and its role as a store of value.

- Ethereum (ETH): Unlike Bitcoin, Ethereum is not just a currency. It’s a platform for building decentralized applications (dApps) using smart contracts—self-executing contracts with the terms of the agreement directly written into code.

- Ripple (XRP): Ripple is designed for fast and low-cost international money transfers. Its network is used by banks and financial institutions, making it more centralized compared to other cryptocurrencies.

- Litecoin (LTC): Often considered the silver to Bitcoin’s gold, Litecoin offers faster transaction times and lower fees, making it more suitable for everyday purchases.

- Cardano (ADA): Cardano is known for its scientific approach to blockchain development. It’s designed to be more secure and scalable than earlier blockchains, and it uses a PoS consensus mechanism.

- Polkadot (DOT): Polkadot aims to enable different blockchains to interoperate with each other, allowing them to share information and functionality.

These cryptocurrencies are just the tip of the iceberg. Each one has a unique community, vision, and technology behind it. Understanding the differences can help you make informed decisions about which cryptocurrencies might be worth your attention.

Unique Uses and Real-World Applications

Cryptocurrencies aren’t just for buying and selling; they have a wide range of applications beyond traditional financial transactions.

- Smart Contracts: On platforms like Ethereum, smart contracts allow for the automatic execution of agreements when certain conditions are met. For example, in real estate, a smart contract could automatically transfer ownership of a property when the buyer sends the agreed payment.

- Decentralized Finance (DeFi): DeFi is an ecosystem of financial applications built on blockchain. It allows people to lend, borrow, and trade assets without the need for a traditional bank. Imagine earning interest on your savings without ever stepping into a bank!

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets representing ownership of a specific item or piece of content, like digital art, music, or even virtual real estate. The popularity of NFTs has skyrocketed, creating new opportunities for artists and content creators.

- Cross-Border Payments: Cryptocurrencies like Ripple are being used to streamline international payments, making them faster and cheaper than traditional methods. This is particularly valuable in regions where access to banking services is limited.

- Supply Chain Management: Blockchain technology can track products as they move through the supply chain, ensuring transparency and authenticity. This is especially useful in industries like food and pharmaceuticals, where trust and traceability are crucial.

- Voting Systems: Blockchain can be used to create secure and transparent voting systems, reducing the risk of fraud and increasing voter participation.

These applications show that cryptocurrency and blockchain technology are far more than just a new form of money. They have the potential to disrupt industries and change the way we interact with the world.

The Benefits of Using Cryptocurrency

Cryptocurrency offers numerous benefits that make it an attractive option for many people and businesses:

- Decentralization: Without a central authority, cryptocurrencies are more resistant to censorship and control by governments or corporations. This gives users more freedom and autonomy over their finances.

- Lower Transaction Costs: Traditional banking systems often involve various fees for international transactions, currency exchanges, and processing. Cryptocurrencies eliminate many of these costs, making it cheaper to send money across borders.

- Fast and Global Transactions: Cryptocurrency transactions can be completed in minutes, regardless of the distance between the sender and receiver. This speed and global reach are unmatched by traditional financial systems.

- Security and Privacy: Cryptocurrencies use advanced encryption to secure transactions and protect users’ identities. While transactions are transparent, personal details are often pseudonymous, providing privacy.

- Financial Inclusion: Cryptocurrencies can be accessed by anyone with an internet connection, making financial services available to people in remote or underserved regions where traditional banking is limited.

- Ownership and Control: With cryptocurrency, you have full ownership and control over your assets. Unlike traditional bank accounts, where access can be restricted or frozen, cryptocurrency wallets are controlled solely by you.

For instance, if you’re a small business owner, accepting cryptocurrency can open up new markets and reduce transaction fees, boosting your profitability.

Risks and Challenges of Cryptocurrency

While cryptocurrency offers exciting opportunities, it also comes with significant risks and challenges:

- Price Volatility: Cryptocurrencies are known for their price swings. This volatility can be profitable for traders but risky for long-term investors or businesses that accept cryptocurrency as payment.

- Regulatory Uncertainty: Governments around the world are still figuring out how to regulate cryptocurrencies. Changes in laws and regulations can have a big impact on the value and legality of cryptocurrencies in different regions.

- Security Risks: While the blockchain itself is secure, cryptocurrency exchanges and wallets are vulnerable to hacking. Several high-profile hacks have resulted in the loss of millions of dollars in cryptocurrencies.

- Irreversibility: Cryptocurrency transactions are final and cannot be reversed. If you send money to the wrong address, there’s no way to get it back unless the recipient agrees to return it.

- Adoption Barriers: Despite growing popularity, cryptocurrency is still not widely accepted for everyday purchases. Convincing more businesses and consumers to use it remains a challenge.

- Environmental Concerns: The energy consumption of cryptocurrency mining, especially in PoW systems like Bitcoin, has raised concerns about its environmental impact. Efforts are being made to develop more sustainable alternatives.

For example, in early 2021, Tesla announced it would accept Bitcoin as payment, only to reverse the decision a few months later due to environmental concerns related to Bitcoin mining. Such incidents highlight the ongoing debate around cryptocurrency’s impact on the planet.

How to Buy and Store Cryptocurrency

Getting started with cryptocurrency might seem daunting, but it’s actually quite straightforward:

- Choose a Cryptocurrency Exchange: First, you’ll need to select an exchange where you can buy, sell, and trade cryptocurrencies. Some of the most popular exchanges are Coinbase, Binance, and Kraken. Each has its own features, fees, and selection of cryptocurrencies.

- Create an Account: Sign up for an account on the exchange. You’ll need to provide some personal information, and in many cases, verify your identity by uploading a government-issued ID.

- Deposit Funds: Once your account is set up, you’ll need to deposit funds. Most exchanges accept deposits via bank transfer, credit card, or even PayPal. Some exchanges also allow you to deposit cryptocurrency if you already have some.

- Buy Cryptocurrency: After depositing funds, you can purchase the cryptocurrency of your choice. You don’t have to buy a whole coin—most exchanges allow you to buy a fraction of a coin, which is great for beginners.

- Store Your Cryptocurrency: Once purchased, you can store your cryptocurrency on the exchange, but this isn’t the safest option. A better approach is to transfer your cryptocurrency to a digital wallet. Wallets can be software-based (like an app on your phone) or hardware-based (a physical device that stores your coins offline).

- Secure Your Investment: Use strong passwords, enable two-factor authentication, and consider using a hardware wallet for long-term storage. Always keep your private keys safe—if you lose them, you lose access to your cryptocurrency.

For instance, if you decide to invest in Ethereum, you could buy it on Coinbase and then transfer it to a Ledger Nano S hardware wallet for safekeeping. This way, your investment is protected from online threats.

The Future of Cryptocurrency

The future of cryptocurrency is a hotly debated topic. Some believe it will replace traditional money entirely, while others see it as a complementary system that will coexist with fiat currencies.

- Mainstream Adoption: More businesses and institutions are starting to accept cryptocurrencies, and even governments are exploring the idea of creating their own digital currencies (Central Bank Digital Currencies, or CBDCs). This growing acceptance could lead to wider adoption and integration into everyday life.

- Technological Advancements: New technologies are being developed to address the challenges of current cryptocurrencies. For example, Ethereum 2.0 aims to solve scalability issues by moving from PoW to PoS, making the network faster and more sustainable.

- Regulatory Developments: As cryptocurrencies gain popularity, governments are working on creating regulatory frameworks to ensure they are used safely and legally. These regulations will shape the future landscape of cryptocurrency.

- Potential Risks: Despite the optimism, cryptocurrencies face challenges, including regulatory crackdowns, technological vulnerabilities, and environmental concerns. How these issues are addressed will determine the trajectory of cryptocurrency in the coming years.

For example, countries like El Salvador have adopted Bitcoin as legal tender, while others like China have cracked down on cryptocurrency mining and trading. These differing approaches illustrate the complex and uncertain future of cryptocurrency.

Final Thoughts

Cryptocurrency is a dynamic and rapidly evolving technology that offers both opportunities and risks. Understanding its basics, from blockchain technology to the different types of cryptocurrencies and their applications, is crucial for anyone looking to get involved.

While it’s impossible to predict the future with certainty, one thing is clear: cryptocurrency is here to stay. Whether you’re an investor, a tech enthusiast, or simply curious, staying informed and prepared is key to navigating this exciting new frontier.

By embracing cryptocurrency, you’re not just participating in a financial revolution; you’re also exploring new ways to interact with the digital world. The journey might be complex, but the potential rewards—both financial and technological—are immense.

So, as you dive into the world of cryptocurrency, remember to do your research, stay updated on the latest trends, and always be cautious with your investments. The future of money is digital, and cryptocurrency is leading the charge.