Imagine waking up to headlines like “Bitcoin Surge All-Time Highs—Again.” Social media is buzzing, investment groups are alight with chatter, and even your non-tech-savvy friends are asking, “Should I buy Bitcoin now?” It’s not just a price rally; it’s a phenomenon. But why now? Why is Bitcoin soaring while other markets are in turmoil?

Bitcoin Surge Why It Is Breaking Records and What It Means

The answer isn’t a simple one-liner. It’s a tapestry of interwoven factors—political shifts, institutional embrace, technological leaps, economic fears, and more.

To truly understand Bitcoin’s unprecedented rise, we need to peel back the layers and explore the unique catalysts driving its momentum. This isn’t just about numbers; it’s about the narratives, human behavior, and systems at play.

Let’s dive in.

How Politics Shapes Bitcoin Surge

In times of political turbulence or change, people tend to gravitate toward financial assets that feel “safe.” Surprisingly, Bitcoin has started to occupy that space.

Take the re-election of Donald Trump, for instance. Love or loathe him, his presidency has historically been associated with economic growth and a market-friendly stance. Investors are betting on a continuation of this trend, and Bitcoin—now viewed as a legitimate asset class—is reaping the benefits.

BREAKING: The Trump Administration is officially the most pro-#Bitcoin in US history

RFK Jr is now the 5th appointee that owns $BTC 🔥 pic.twitter.com/B5VExr0tyH

— The Bitcoin Historian (@pete_rizzo_) November 14, 2024

But it’s not just about the president. Behind the scenes, there’s mounting chatter about regulatory clarity. Under Trump’s administration, there’s hope for more crypto-friendly policies, potentially unlocking institutional capital that’s been sitting on the sidelines. For retail investors, this creates a sense of urgency: If Wall Street is diving in, shouldn’t I?

When Big Money Talks, Everyone Listens

Picture this: MicroStrategy, a software company, has turned Bitcoin into its treasury darling. Microstrategy has poured billions into Bitcoin, signaling to the world that this isn’t a fringe investment anymore. It’s a store of value, akin to digital gold.

But MicroStrategy isn’t alone. Tesla, Square, and even hedge funds are now adding Bitcoin to their balance sheets. What’s happening here? These corporations aren’t just chasing gains—they’re hedging against inflation, diversifying their portfolios, and, frankly, making a statement. Bitcoin’s narrative has shifted from “risky” to “reliable.”

And then there are ETFs (Exchange-Traded Funds). While these may seem like a Wall Street technicality, they’re game-changers. ETFs make Bitcoin accessible to institutional investors who were previously wary of its complexities. With just a few clicks, traditional portfolios can now include Bitcoin exposure. This accessibility is driving demand in ways we’ve never seen before.

Why Bitcoin Just Got Smarter

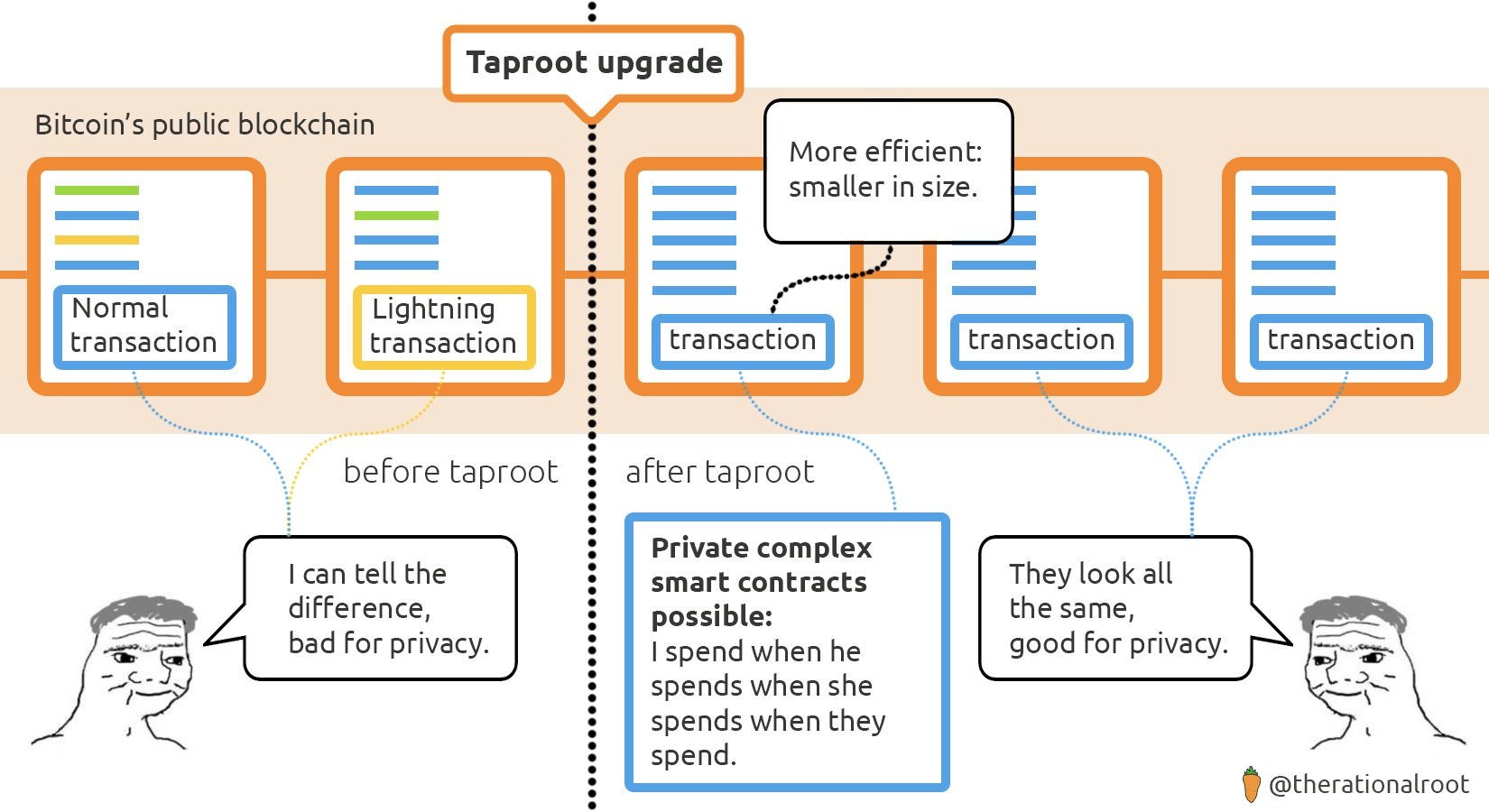

Bitcoin isn’t just riding on sentiment; it’s upgrading itself to meet the demands of a digital-first world. Enter the Taproot upgrade. This isn’t just technical mumbo-jumbo—it’s a watershed moment.

Taproot enhances privacy, reduces transaction costs, and introduces smart contract functionality. In plain terms, it makes Bitcoin more versatile and competitive with blockchain platforms like Ethereum.

And then there’s the Lightning Network. Ever tried buying a coffee with Bitcoin? The transaction fees probably cost more than the coffee. The Lightning Network is changing that. By enabling faster and cheaper microtransactions, it’s transforming Bitcoin into a viable currency for everyday use. This isn’t just an upgrade; it’s a redefinition of what Bitcoin can do.

Inflation and Economic Uncertainty

Let’s talk about inflation. Globally, the cost of living is rising, and fiat currencies are losing their purchasing power. Central banks are printing money at unprecedented rates, and people are asking, “Where can I store my wealth where it won’t evaporate?” For many, the answer is Bitcoin.

Bitcoin’s fixed supply—only 21 million coins will ever exist—makes it inherently deflationary. This scarcity, coupled with growing distrust in traditional financial systems, has positioned Bitcoin as a hedge. It’s not just an investment; it’s a lifeboat.

Economic instability further amplifies this trend. In countries facing hyperinflation or political unrest, Bitcoin isn’t a luxury—it’s a necessity. Its decentralized nature means no government can confiscate or devalue it. That’s powerful.

FOMO: The Fear of Missing Out

Bitcoin’s rally isn’t just about fundamentals; it’s about psychology. As prices climb, so does the fear of missing out (FOMO). Social media amplifies this effect, creating a feedback loop where more investors pile in, driving prices even higher.

Think about the conversations happening around dinner tables: “Did you hear about Bitcoin? My friend’s brother doubled his money last month!” These stories, whether exaggerated or not, fuel herd behavior.

The Media Machine

Media coverage plays a crucial role too. When Bitcoin is on the rise, headlines like “Bitcoin Breaks $60K” dominate the news cycle.

This constant exposure builds legitimacy and curiosity, pulling even skeptical investors into the fold. It’s the classic “I saw it on the news, so it must be real” effect.

The Halving Effect

Bitcoin’s design includes a feature called “halving,” where the reward for mining new blocks is cut in half every four years. This isn’t just a cool technical feature—it’s an economic masterstroke.

By reducing the rate of new Bitcoin entering the market, halving events create artificial scarcity. And when demand outpaces supply, prices soar.

Mining: The Backbone of Bitcoin

Behind every Bitcoin transaction is a network of miners. These are the people (and machines) solving complex mathematical problems to validate transactions.

But mining isn’t cheap.

Rising energy costs and competition mean only the most efficient miners can stay in the game. This dynamic further tightens supply, adding upward pressure to prices.

Why This Moment Matters

Bitcoin’s unprecedented surge is more than a financial story; it’s a cultural shift. It’s the result of political winds, institutional validation, technological innovation, economic fears, psychological momentum, and supply constraints.

Together, these forces have propelled Bitcoin into uncharted territory, making it more than just an asset—it’s a movement.

Looking Ahead

What’s next for Bitcoin? Regulatory clarity could either boost or temper its momentum. Technological advancements will continue to expand its use cases. And as macroeconomic uncertainties persist, Bitcoin’s role as a hedge will only grow stronger.

For investors, the key is understanding the big picture. Bitcoin isn’t just about today’s price—it’s about the future of money, finance, and freedom.

Are you ready to embrace it?